“Always show your working out!” was the mantra of my maths teacher in senior school. This series of blog posts “On the Nature of Lean Portfolios” is an exploration of Lean Portfolios. It is the thought processes running through my mind, exploring the possibilities so that I understand why things are happening rather than just doing those things blindly. It is not intended to be a fait-accompli presentation of the Solutions within Lean Portfolios but an exploration of the Problems to understand whether the Solutions make sense. There are no guarantees that these discussions are correct, but I am hopeful that the journey of exploration itself will prove educational as things are learnt on the way.

What Style of Portfolio Do You Have?

The style of the Portfolio influences how you approach decision making within the Portfolio. Certain styles of portfolio are going to allow more freedoms than other styles which have more constraints. The style is going to influence how some of the activities within the Portfolio are approached.

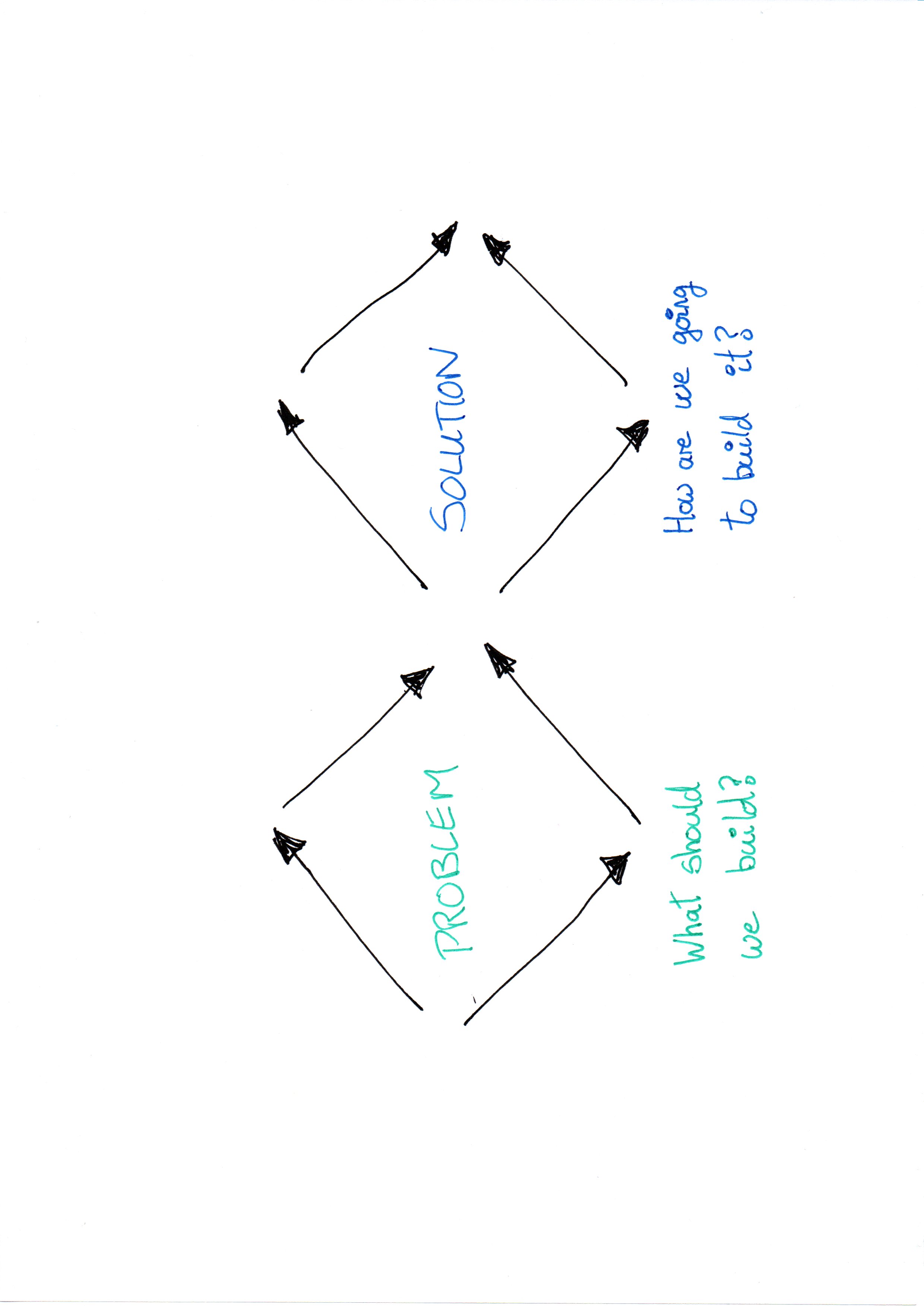

Using Design Thinking principles, we want to separate the Problem from the Solution. For the purposes of the following explanations:

- Problem Space is: What should be built next? The functionality that will delight our customers.

- Solution Space is: How do we build the next thing? The technical solutions that provide the functionality.

With the separation of Problem from Solution in mind we can now look at the different styles of Portfolio and the underlying constraints that are dictating the style of portfolio that is operating.

With the separation of Problem from Solution in mind we can now look at the different styles of Portfolio and the underlying constraints that are dictating the style of portfolio that is operating.

Experimental

An Experimental Portfolio can experiment in both the Problem and Solution space. The Portfolio funding has no external constraints on how that funding is spent, thereby allowing the Portfolio to experiment around what it could do to generate the most Return On Investment. for the available funding. Often the funding is the money the Portfolio has raised through sales of their product and therefore the Portfolio has freedom of choice in how it can be spent.

Real World examples are Product companies producing Product or Services that generate value.

This is what SAFe wants to everyone to be and what everyone should be striving to be in order to give themselves the greatest chance of success; but is often far removed from what organisations are usually set up for. The Portfolio is “Experimental” because it is continually experimenting with new ideas for products or functionality on existing products.

Production

A Production Portfolio has limited ability to experiment in the Problem Space; the work it needs to do is being dictated to it and the work is non-negotiable. Experimentation is confined to the Solution Space only; the Portfolio must Produce solutions.

Real World examples are Risk Reporting1 within an Investment Bank. The work is being dictated externally; Regulators notify the Bank of the work they would like done, the Risks and Scenarios that the bank needs to report on. The bank must produce the requested work or the bank gets fined or is refused permission to trade.

If you’ve ever been reading through the Portfolio material within SAFe and wonder why it sometimes looks like it has a split personality, you can be experimental but you can also have multi-year roadmaps, it’s because they need to encompass this style of Portfolio but they don’t acknowledge why it is different from an Experimental Portfolio and where the trade-offs and conflicts are within the Portfolio processes that you could use. Multi-year roadmaps are great for forecasting Production Portfolios but more challenging in an Experimental Portfolio where the first experiment could result in a pivot that completely changes the direction of the portfolio.

Personnel

The Portfolio here is in a completely different dimension, the People space. Unlike the previous two examples which are Product Portfolios, the investment decisions are being made in the Personnel space. This is the scenario that Systems Integrators and Outsourcing companies fall into. They are bidding on contracts, and hopefully winning them, therefore they need to ensure that they have the right people with the right skills in the right place at the right time to service those contracts and satisfy the customer.

Experimentation in Product Terms is potentially possible within both the Problem and Solution space but must occur within the context of the contract. The Portfolio cannot use the money from the Contract for other purposes until the terms of the contract have been fulfilled and the excess, the profit, can utilised elsewhere.

A thought occurs…

All portfolios are about getting People into the right place to achieve the vision of the Portfolio. The investment is made in the people to get them into the right place to get the work done, the rationale behind how they are arranged is therefore driven by the nature of the work.

It is the nature of the work, and any commitments attached to that work, that drive the style of the Portfolio. If there has been a commitment made then honouring that commitment should take priority over the use of the money/effort elsewhere in the company; only the excess money/effort, the profit, can be utilised elsewhere. The commitment could be external which leads to Production or Personnel style Portfolios. Experimental portfolios where the Portfolio is working for itself provide a much greater range of freedoms in how to disperse the money/effort.

Conclusions

The commitments attached to the work influence the style of Portfolio and will impose constraints on the processes the Portfolio is utilising. Budgeting and Forecasting are two topics that will be heavily influenced by the constraints on the work and are topics that I intend to investigate in future posts.

Having some means of classification to act a baseline of expectations is always a useful starting point for discussions. I make no claims that the three styles presented here encompass all styles of Portfolio but they are indicative of the styles of Portfolio that tends to be encountered in the R&D space and are enough to help shape some of the future articles.

#1 You could argue that Risk Reporting should not be a Portfolio in its own right, but the “tail can’t wag the dog”; a few hundred IT staff cannot dictate to the few thousand bank staff how the greater bank should be organised and run. If the greater bank has decided that Risk Reporting is a thing and wants to treat it as Portfolio, then we must work with what we’ve got.

More Great Topics for Agile Teams

How many Features do you take to PO Planning? PI Planning Tips

On the Nature of Portfolios; WSJF Estimating Portfolio & WSJF

Program Level WSJF & Feature Slicing Program WSJF & Feature Slicing

All about Managing Dispersed Planning; WSJF Estimating Dispersed Planning Series

States of Epics The EPIC lifecycle